Why Should You Become a Nurse Practitioner?

If you are looking for a way to advance your …

Why Should You Become a Nurse Practitioner? Read MoreLet's Talk Total Health

If you are looking for a way to advance your …

Why Should You Become a Nurse Practitioner? Read More

In the quest for recovery, practicing mindfulness is a beacon …

Embracing Mindfulness in Recovery: A Guide to Enhancing Sobriety and Well-being Read More

Are you on the hunt for the secret to staying …

Separating Fact from Fiction: The Truth About Anti-Aging Supplements Read More

Hey there! Let’s talk about something super important for both …

Why You Should Get Your Testosterone Levels Checked? Read More

When someone you care about is going through the challenging …

Embracing the Role of Support in Recovery Read More

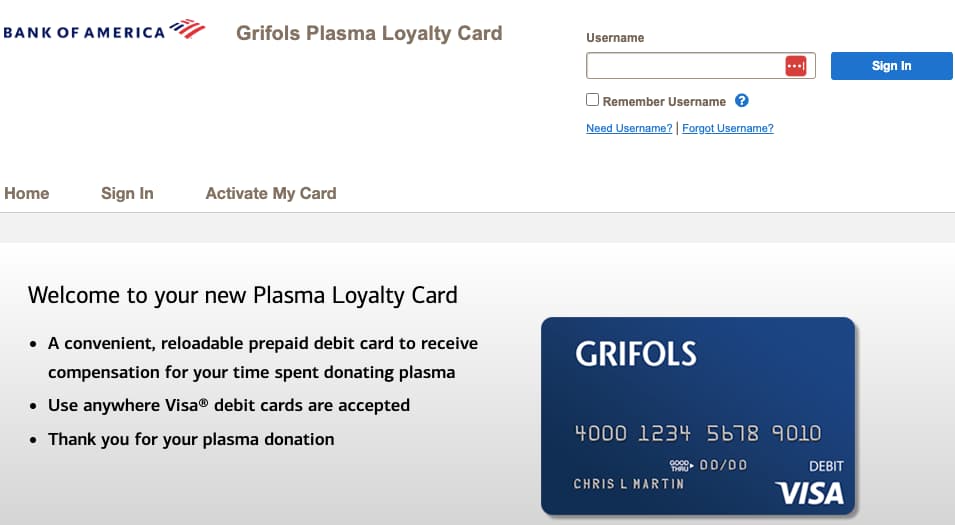

Hey there! Today, we’re going to talk about something cool …

Bank of America Plasma Loyalty Card Activate Login Account Read More

Alcohol addiction is a pervasive problem that requires attention to …

Best Alcohol Addiction Treatment Options in 2024 Read More

Hey there fitness enthusiasts! Are you looking to pack on …

Best Bodybuilding Supplements for Muscle Mass in 2024 Read More

Movement is not only a form of physical activity but …

The Joy of Movement: 8 Hobbies for Dancers and Gymnasts Read More

You must be logged in to post a comment.